Machine Mania in the Marketplace: How Computers Came to Own the World

The following article by David Haggith is from The Great Recession Blog:

The following article by David Haggith is from The Great Recession Blog:

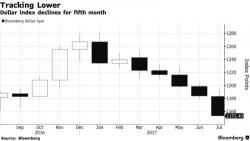

Welcome to August: you may be surprised to learn that S&P 500 futures are once again levitating, higher by 0.3%, and tracking European and Asian markets. Asian equities traded higher across the board after China's Caixin Manufacturing PMI beat expectations and printed its highest since March, refuting the decline in the official PMI data reported a day earlier, while firmer commodity prices boost both sentiment and commodity stocks across Asia and Europe.

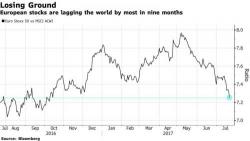

In a mixed session, which has seen Asian stocks ex-Japan broadly higher, the European Stoxx 600 index dropped as much as 0.6% after data Markit PMI data signalled euro-area economy grew in July at its slowest pace in six months while carmakers extended declines on continued concern about antitrust collusion in the industry. Germany’s DAX Index was hardest-hit euro-area benchmark, down as much as 0.8%. Autos continued to be the worst-performing sector on the Stoxx Europe 600 after EU and German regulators said they are studying possible collusion among German automakers.

Submitted by Ronan Manly, BullionStar.com

The COMEX gold futures market and the London OTC gold market have a joint monopoly on setting the international gold price. This is because these two markets generate the largest ‘gold’ trading volumes and have the highest ‘liquidity’. However, this price setting dominance is despite either of these two markets actually trading physical gold bars. Both markets merely trade different forms of derivatives of gold bars.

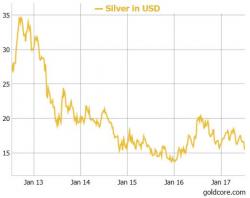

“Silver’s Plunge Is Nearing Completion”