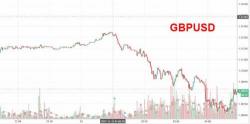

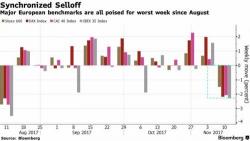

Global Stocks Tumble, Asia Plunges On Chinese Commodity Carnage

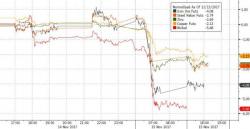

The euphoria of the past month has ended with a thud and BTFDers are strangely missing as the commodity chill out of China (which overnight became full blown carnage), has unleashed a global risk-off phase ahead of today's critical CPI data, resulting in broad and sharp selling across global markets, as European stocks followed declines in Asia while bonds and gold advanced. The equity retreat, which spread to U.S. stock futures, started with last night's sharp puke in Chinese commodities.