All Eyes On Yellen After US Futures, Euro Stocks Rebound On Latest French Polls

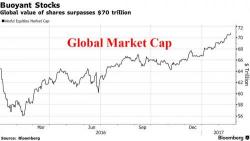

World stocks pulled back from all time highs, and European bourses initially followed U.S. futures and Asian shares lower, however both European risk sentiment as well as E-Minis rebounded after an Odoxa poll showed Macron overtaking Le Pen in the 1st round for the first time, and that the addition of Juppe instead of Fillon may see a 2nd round run-off between Macron vs Juppe, leading to a slump in Bund futures to session lows, and a bounce in European stocks.