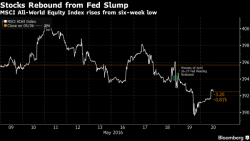

Stronger Dollar Sends Futures Higher, Oil Lower, Asian Stocks To Two Month Lows

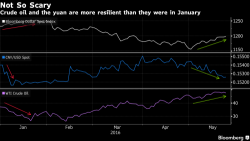

Yesterday's weak dollar headfake has ended and overnight the USD rallied, while Asian stocks dropped to the lowest level in 7 weeks and crude oil fell as speculation returned that the Federal Reserve will raise interest rates as early as next month. The pound jumped and European stocks gained thanks to a weaker EUR.