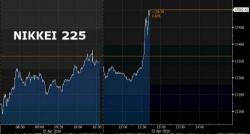

"Unexpected" Australian Rate Cut To Record Low Unleashes FX Havoc, Global "Risk Off"

Three months ago, when Australia unexpectedly revealed that its recent "stellar" job numbers had in fact been cooked we asked, rhetorically, why the sudden admission it was all a lie? Simple: weakness in commodity prices "is far greater than people had been expecting,” the nation's top economist said. Australia is now "swimming against the tide" because of uncertainties in the global economy, he added.