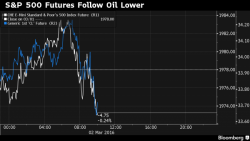

Furious Rally Fizzles Overnight As Futures Follow Oil Lower

Following yesterday's torrid 2.4% March opening rally, which resulted in the biggest S&P gain since January and the best first day of March in history on what was initially seen as very bad news, and then reinterpreted as great news, overnight futures have taken a breather, and erased a modest overnight continuation rally to track the price of oil lower.