Dollar Rebounds, Futures Rise Ahead Of Surge In Payrolls

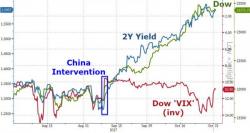

One day after the dollar slumped sharply on initial disappointment with the GOP tax plan, the greenback has rebounded ahead of a nonfarm payrolls report that is expected to show the US economy gained over 300,000 jobs in the post-hurricane rebound, and as investors reassessed the latest news on U.S. tax-cut plans. Stocks in Europe and Asia advanced, US equity futures were as usual in the green, while oil headed for an eight-month high on signs OPEC will agree to extend supply cuts.