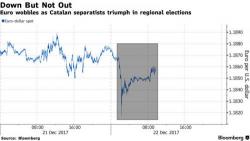

"This is Groundhog Day": Spanish Stocks Battered By Catalan Vote, Bitcoin Crashes

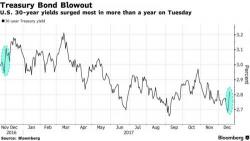

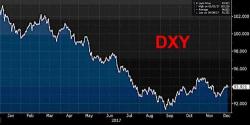

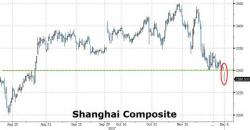

Spanish stocks and the euro fell, while Spanish government bond yields hit their highest levels in over a month after Catalan secessionists delivered an unexpected blow to the government of Spanish PM Rajoy by winning the Catalan regional election. Meanwhile across the Atlantic, U.S. equity futures and the dollar rose on the last trading session before the Christmas holiday. The MSCI index of world stocks was flat.