IMF Rings The Alarm On Canada's Economy

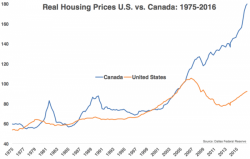

Shortly after yesterday's rate hike by the Bank of Canada, its first since 2010, we warned that as rates in Canada begin to rise, the local economy which has seen a striking decline in hourly earnings in the past year, which remains greatly reliant on a vibrant construction sector, and where households are the most levered on record, if there is anything that can burst the local housing bubble, it is tighter monetary conditions. And a bubble it is, as the chart below clearly demonstrates...