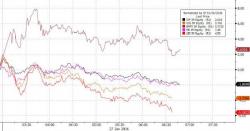

Italian Banks Sink As "Bad Bank" Plan Underwhelms

Last week, we noted that Italy is rushing to defuse a €200 billion time bomb in the country’s banking sector as investors fret over banks’ exposure to souring loans.

“Italian banks’ share prices have been volatile YTD, given the market’s renewed fears over asset quality and potential developments on a possible bad bank creation,” Citi wrote, in a note analyzing which Italian banks are most exposed. “Total gross NPLs in Italy have increased by c160% since 2009 and now represents c18% of loans (vs c8% in 2009).”