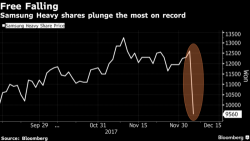

World's Third Largest Shipbuilder Crashes 29% Amid Asian Equity Carnage

Shares in Samsung Heavy, the world’s third largest shipbuilder, plunged by 29% during Wednesday’s trading session after unexpectedly forecasting operating losses this year and 2018 and announcing a capital raise. Meanwhile, Asian equities tumbled, led by technology, mining and industrial companies, with the MSCI Asia Pacific Index falling for eight straight days, its longest run of down days since 2015.