World Stocks Rebound, Dollar Rises As Korea Nuclear War Fears Recede

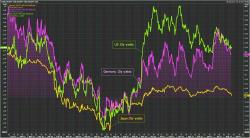

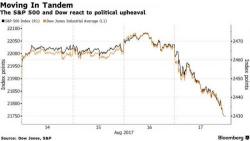

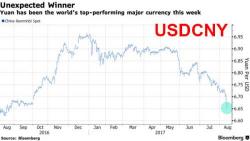

S&P futures are higher in early Wednesday trading, alongside Asian stocks and European bourses, both solidly in the green as the EURUSD drifts below the 1.20 "redline" while the dollar rebounds off a two and a half year low following the US "measured" response to North Korea’s missile test, which soothed jittery investors who now turn their focus to US economic data. Equity indexes in Japan, Hong Kong and South Korea also rose while 10Y US Treasuries are steady before the release of ADP employment and GDP data, both of which are expected to show an increase.