European Stocks, US Futures Rise, Dollar Steady Ahead Of Powell Hearing, Tax Debate

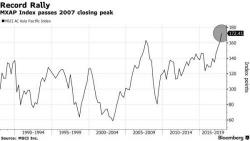

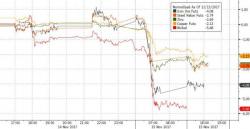

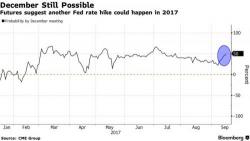

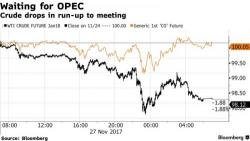

US equity futures in the green ahead of critical Senate debate on US tax reform and a much anticipated testimony from Yellen replacement Jerome Powell for Fed’s current policy approach. European stocks advance, led by oil and gas stocks after Shell fully restored its cash dividend and unveiled a bullish outlook. Asian shares slide despite the reappearance of the Chinese "National Team" which stabilized the SHCOMP selloff in the last hour. USD recovers gradually from overnight lows against G-10, pushing GBP/USD and EUR/USD to session lows, while oil and treasuries edged lower.