Nasdaq Plunges Most Since September After H1-B Rumor

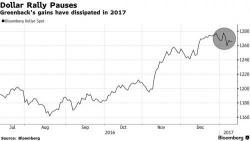

Following leaks this morning that the Trump administration is considering executive orders around the H1-B worker via program, tech stocks are tumbling with the Nasdaq down most since September...

Additionally, the S&P 500 just dropped 1.0% for the first time since October...

And VIX is spiking above key technical levels (50DMA) - the biggest spike since September...