Global Stocks Rise, Copper Soars In Thin Holiday Volumes

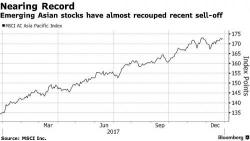

European stocks are steady in post-Christmas trading if struggling for traction after a mixed session in Asia, amid trading thinned by a holiday-shortened week and ongoing worries about the tech sector; however a strong rally in commodities - including copper and oil - buoyed expectations for a strong 2018 and helped offset concerns over the technology sector triggered by reports of soft iPhone X demand.