Is It Time To Reconsider A World View Where Most People See The Glass Half-Empty?

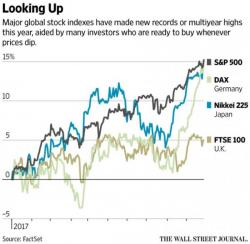

"If you can't beat 'em, join 'em" seems to be the clarion call from many in the markets as traders who should, and do, know better, hold their noses, pluck out their eyes, plug their ears and buy stocks with both hands and feet. As former fund manager Richard Breslow noted this morning, there's something different with this equity rally.

Different indeed...

Via Bloomberg,