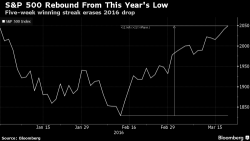

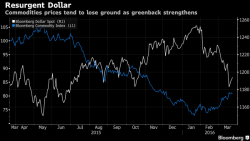

Dollar Winning Streak Continues For Fourth Day Pushing Oil Lower; Futures Flat

Following two days of rangebound moves, where Monday's modest market rebound was undone by the Tuesday just as modest decline (despite the early surge higher on the latest "bullish for stocks" European terrorism), overnight equity action continued to be more of the same, and as of this moment S&P 500 futures were unchanged, while European stocks were modestly higher.