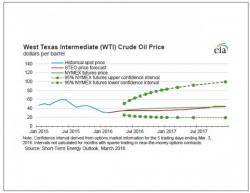

EIA's Dire Oil Forecast: $34 Crude Due To Far More Resilient Production, Oversupply And Lower Demand

Now that the massive USO-driven squeeze appears to be over (congratulations to whoever managed to sell equity and their secured lenders) the bad news can return. First, it was Goldman slamming the "unsustainable rally, and then just a few hours ago, the EIA released its latest monthly short-term outlook report in which it brought even more bad news for long-suffering bulls who thought the pain was finally over.