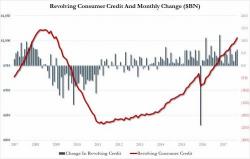

The Fed Issues A Subprime Warning As Household Debt Hits A New All Time High

After we first reported last week that US credit card debt once again rose above $1 trillion, despite a recent sharp downward revision to the data, while both student and auto loans rose to a fresh record high...