Groundhog Day Trading: Stocks Slide As Oil Plunge Returns; BP Suffers Biggest Loss On Record

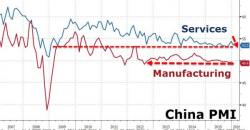

It certainly does feel like groundhog day today because while last week's near record oil surge is long forgotten, and one can debate the impact the result of last night's Iowa primary which saw Trump disappoint to an ascendant Ted Cruz while Hillary and Bernie were practically tied, one thing is certain: today's continued decline in crude, which has seen Brent and WTI both tumble by over 3% has once again pushed global stocks and US equity futures lower, offsetting the euphoria from last night's earnings beat by Google which made Alphabet the largest company in th