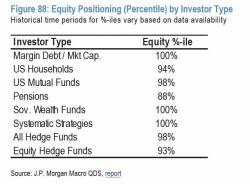

Charted: What are Retail Investors Interested in Buying in 2023?

Charted: Retail Investors’ Top Picks for 2023

U.S. retail investors, enticed by a brief pause in the interest rate cycle, came roaring back in the early summer. But what are their investment priorities for the second half of 2023?