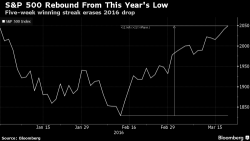

Global Stocks Jump, Crude Booms As Yellen Looms

S&P futures were fractionally higher (+0.1% to 2,476) with all eyes on the Fed's rate decision as investors await another earnings deluge from companies including Facebook, Coca-Cola and Boeing. Asian and European shares were also higher, prompted by momentum from the latest US record high; the Dollar rebound continued while oil rose above $48 as copper hit a two year high.