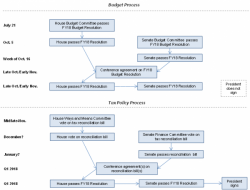

Congress Takes The First Step To Pass Tax Reform: Here's What Comes Next

Today The House passed the 2018 budget resolution in a 219-207 mostly party-line vote (18 republicans voted against the resolution along with all Democrats), representing the first step toward the Republican goal of sending tax-reform legislation to President Trump.