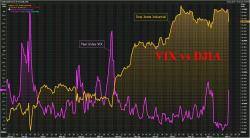

Selloff Accelerates As Trump Fears Mount: "The Market Will Revert To Much Higher Volatility"

European and Asian stocks slumped on Thursday following the worst one-day drop in US stocks in 8 months, while S&P futures tumbled to session lows, down 0.3% to 2,350 after initially posting a modest rebound, following a new Reuters report alleging that Trump campaign members communication with Russians on at least 18 occasions, and which prompted today's risk off mood sending the USDJPY crashing by 100 pips from overnight highs of 111.40.