World Stocks Pull Back Amid Rising Concerns Of A Market Correction

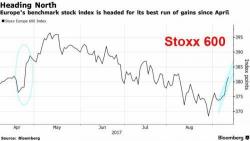

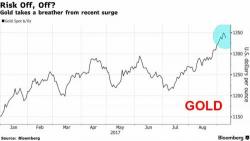

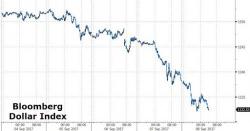

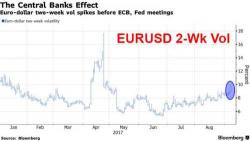

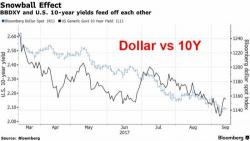

For the first day in three S&P futures have pulled back modestly from record levels as some investors cautioned that gains had gone too far, too fast, European shares are mixed while Asian equities extended their longest rising streak in almost two months as continued gains in Japan and India offset the losses in Hong Kong. The dollar ended a two-day advance as TSY yields dropped in what has become a close correlation trade (see below) while oil and gold rose, perhaps in response to the ongoing plunge in bitcoin.