Party Like The Dow Is 19,999: US Futures Dip As Global Currencies Stumble; Oil Down, Gold Up

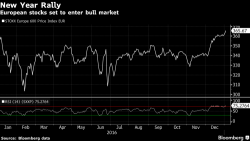

European, Asian stocks fall and U.S. equity-index futures traded mixed on Monday with fresh memories of the Dow Jones rising to under 1 point of 20,000 on Friday. The dollar has rebounded on fresh geopolitical concerns, while the pound extends its decline from Friday and has slide to 10 week lows on a Sunday interview from Theresa May which suggested a "Hard Brexit" may be in the cards. Oil dropped below $54 a barrel on Iran supply concerns, while gold rose 0.6% to $1,180.