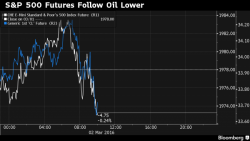

S&P Futures Jump As Rebound In Commodities Helps Defense Of Key Support Trendline

After yesterday's last hour selloff sent the S&P to the very edge of the critical support trendline which, as shown yesterday, meant 1980 had to be defended at all costs...

... so far the support has held, and in overnight trading European stocks have managed to rebound on the back of more levitation in oil, while US equity futures have ignored a drop in the USDJPY which touched 112.20 in morning trading, and have jumped by 0.5% as of this moment, up 10 points to 1,990.