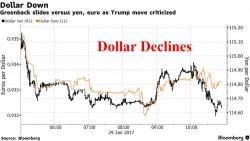

"They 'Buy The Dip' Yet Again": Global Stocks, US Futures Rebound; Dollar Rises Off 4 Month Lows

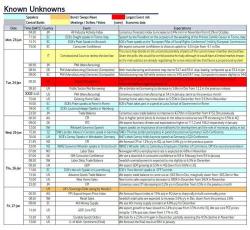

European, Asian stocks have rebounded as investor anxiety over Trump economic policy and US tax reform eased following yesterday's remarkable comeback in the US market. S&P futures point to a slightly higher open, with oil higher and the dollar rebounding off fout month lows. It is a relatively quiet day in the US with the economic calendar focusing on wholesale inventories, consumer confidence and the Case-Shiller index.