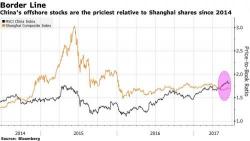

MSCI Finally Adds China A Shares To Its Emerging Market Index

After three consecutive unsuccessful attempts by China to have its A Shares included in the MSCI Emerging Market index, moments ago the fourth time proved to be the charm, when MSCI finally relented and agreed to add China's A shares to the much desired index.