World Stocks Hit Record High For 10th Consecutive Day In "No-Vol Nirvana"

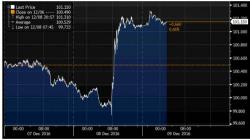

The relentless risk levitation continued overnight, as global shares extended their stretch of consecutive record highs on Thursday for a 10th day after a cautious BOJ lifted Asian stocks to a decade high with a dovish announcement that offered no surprises, while pushing back Kuroda's 2% inflation target to 2020, the 6th consecutive delay. With all eyes on the ECB in just over an hour, US equity futures are in the green, following solid gains around the globe. European stocks extended their biggest gain in a week while Asian equities maintained their rally.