Global Stocks Rise On Strong Economic Data, Dollar Set To End Streak Of Monthly Declines

It's groundhog day as S&P futures, European and Asian shares all rise overnight, while the dollar is set to .

It's groundhog day as S&P futures, European and Asian shares all rise overnight, while the dollar is set to .

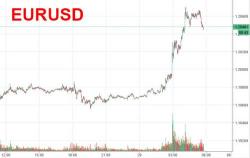

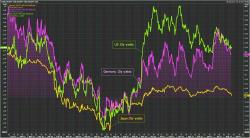

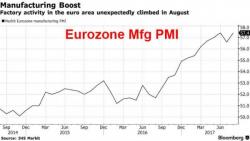

S&P futures are higher in early Wednesday trading, alongside Asian stocks and European bourses, both solidly in the green as the EURUSD drifts below the 1.20 "redline" while the dollar rebounds off a two and a half year low following the US "measured" response to North Korea’s missile test, which soothed jittery investors who now turn their focus to US economic data. Equity indexes in Japan, Hong Kong and South Korea also rose while 10Y US Treasuries are steady before the release of ADP employment and GDP data, both of which are expected to show an increase.

“Financial markets think the only realistic option for the U.S. and North Korea will be to sit down and talk at some point because other options are too costly for everyone involved. But no one can rule out the risk of accidents. Markets think the chicken game will continue for now and North Korea will remain a risk.”

- Masayoshi Kichikawa, chief strategist at Sumitomo Mitsui.

Global markets are stuck in a holding pattern with S&P futures up modestly after fluctuating overnight, as European and Asian shares rise with oil while the dollar has dipped lower ahead of the biggest central bank event of the year: the Fed's Jackson Hole symposium where Janet Yellen and Mario Draghi will speak at 10am and 3pm ET, respectively. Meanwhile, world stocks drifted toward their best week in six on Friday, as a near three-year high in emerging markets shares and a roaring rally in industrial metals bolstered the year’s global bull run.

Yesterday, when stocks surged at the market open following Politico's report that Trump is unexpectedly "making strides" on tax reform, we warned that "it can all be wiped away as soon as tonight, when Trump will deliver a speech to his "base", in which he may promptly burn any of the goodwill he created with capital markets following his far more conventional Afghanistan speech last night."Well, that's precisely what happened, because on Tuesday night, in another fiery campaign rally, Trump fiercely defended his response to violence in Charlottesville, made passing remarks from a