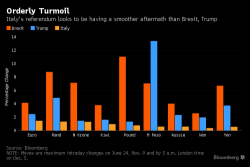

Global Stocks Rise As Oil Dips; US Stock Futures And Dollar Flat

European and Asian markets rose, while U.S. index futures were little changed, with the Dow Jones Industrial Average pushing for yet another record, as traders digested the Italian referendum news, await the ECB's Thursday announcement and reflect in a notably quieter overnight session. Oil slipped from a 16-month high after 4 straight days of gains, as doubts emerged about how OPEC will implement the first supply curbs in eight years. European bonds gained with stocks.