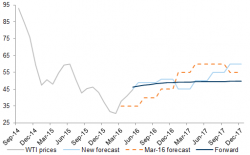

Futures Fizzle After Oil Fades Bounce Above $48

It has been more of the same overnight, as global stocks piggybacked on the strong US close and rose despite the lack of good (or bad) macro news, propelled higher by the two usual suspects: a higher USDJPY and a even higher oil, if mostly early on in the trading session.

Yes, the oil squeeze higher continues, and as the charts below courtesy of Andy Critchlow show, Brent is now 82% higher in the past 82 days...

... while crude has had its strongest rally since 2010.