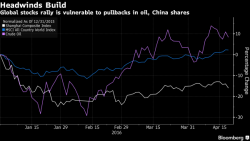

Crude Slides After Kuwait Strikes Ends; China Markets Tumble

The biggest catalyst for overnight markets, first reported on this site, was the announcement by Kuwait that its oil workers had ended their strike which disrupted oil production in the 4th largest OPEC producer for 3 days cutting it by as much as 1.7 mmb/d, and had served to offset the negative news from the Doha debacle. Kuwait Petroleum also added that it would boost output to 3m b/d within 3 days, which in turn has pressured the price of oil overnight, and the May WTI contract was back to just over $40 at last check, sliding 2%.