For Mario Draghi, None Of This Was Supposed To Happen

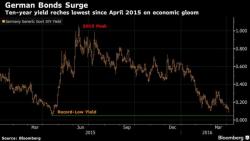

Almost exactly one month ago, on March 10,Mario Draghi unveiled his quadruple bazooka, which among other features, included the first ever monetization of corporate bonds (this has unleashed such an unprecedented scramble for European bonds that there are virtually none left in the open market leading to massive illiquidity and forcing yield chasers to sell CDS instead of buying bonds, thus laying the ground work for the next AIG debacle).