Jim Grant: "Markets Trust Too Much In The Presence Of Central Banks"

Authored by Christoph Gisiger via Finanz und Wirtschaft,

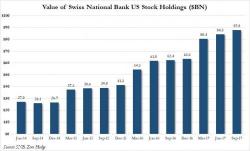

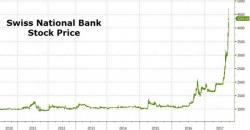

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank.

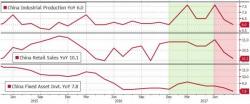

Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm.