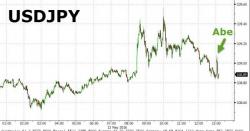

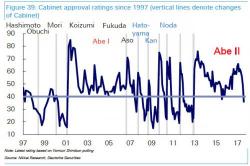

Abe's Days Numbered? DB Warns Japan PM "May Be Forced Out" Leading To Spike In Yields

Almost exactly ten years ago, on September 12, 2007 Japan's current prime minister Shinzo Abe resigned less than a year into a tenure dogged by scandals, the suicide of a minister, a raft of resignations and corruption allegations, and a humiliating election drubbing for his Liberal Democratic Party. Never one to shrink away from resposibility, Abe blamed it on crippling diarrhea: