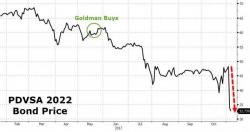

Goldman's Asset Arm Takes Big Hit On Venezuelan Bond Bloodbath

The fallout from the Venezuelan bond restructuring has claimed a major victim in Goldman Sachs Asset Management, or rather some of the “muppets” who trusted Goldman to invest their money. However, the route which led Goldman to losing a chunk of client money wasn’t just a case of bad judgement, being riddled with the usual mixture of greed, questionable ethics and government intervention. As we detailed in “Goldman Accused Of Funding Maduro’s Dictatorship”.