From the Slope of Hope: Perhaps the best-known publicly-traded stock on the planet is Apple. There are a couple of things about Apple that would probably surprise a lot of people. First, as marvelous as the percentage gain was during the "golden dozen years" (2003-2015) of this stock, there are many stocks - - far, far more boring companies - - whose percentage gains completely dwarf Apple's. I've mentioned them before, but basically, the more dull the company (Hormel, Smuckers, etc.) the more amazing the gains have been.

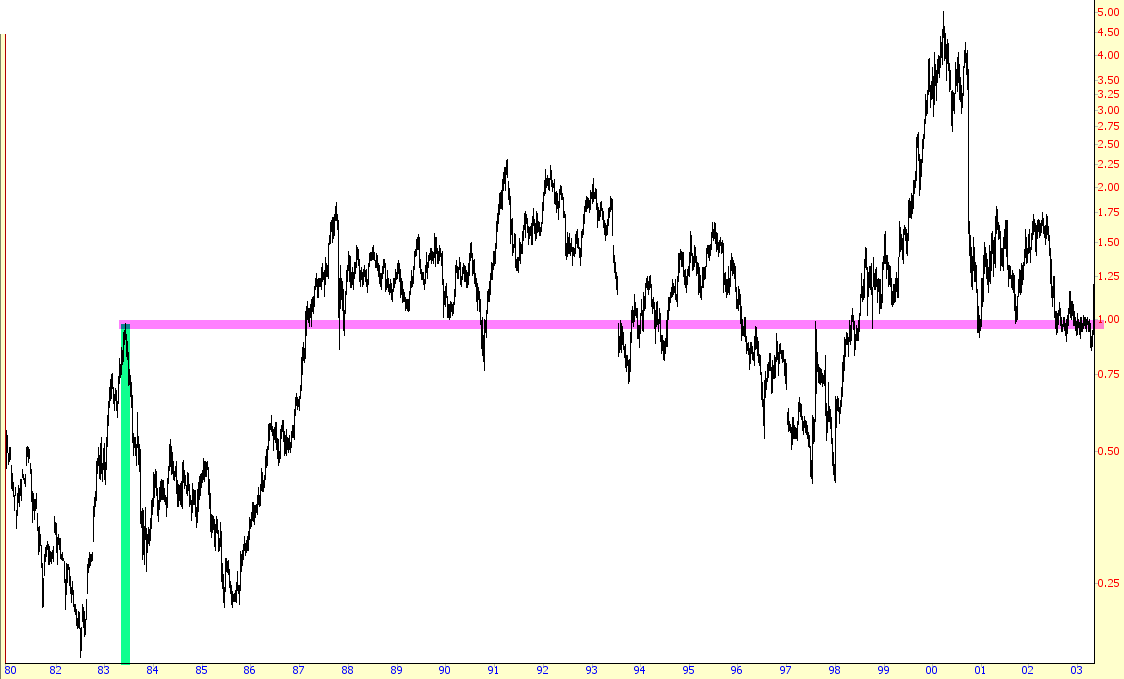

Second, for a huge period of time, Apple was an absolutely awful stock. It had its ups and downs, but the 1983 to 2003, a period of two entire decades, the stock went nowhere. And keep in mind, this 0% return was six years after Jobs' glorious return, and well into the success of the iPod product line. Take note of the magenta line below and see how, in spite of wild swings, Apple was dead money for a twenty year span of time.

Apple, of course, is a tremendously successful firm, and they have an ungodly amount of liquid assets piled up. Keep in mind, however, that Apple does have its occasional bouts of weakness, some of them simply shared with the market as a whole (like 2007/2008) and others that are pretty much just Apple being weak all by itself. My view is that we are in the throes of another one of these Apple tops.

[image]https://slopeofhope.com/wp-content/uploads/2016/04/0417-AAPLBUMPS.png[/image]

More specifically, AAPL dropped from about 132 to 92 (a 30% drop, which represents a twelve-figure diminishment in market cap) only to recover to its present value of about 110. My firm belief is that it will retrace that recovery and break down into the lower 80s before it's all over.

[image]https://slopeofhope.com/wp-content/uploads/2016/04/0417-AAPL.png[/image]

Earnings are coming up after the close on April 25th, so that could be the first meaningful reason to help things lower.