Wolf Richter wolfstreet.com

The amount it costs to ship containers from China to ports around the world, a function of the quantity of goods to be shipped and the supply of vessels to ship them, just dropped to a new historic low.

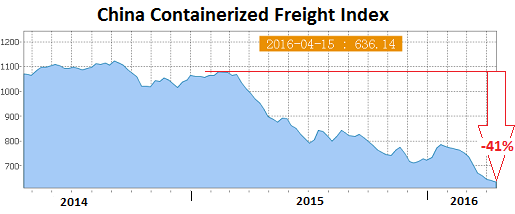

The China Containerized Freight Index (CCFI) tracks contractual and spot-market rates for shipping containers from major ports in China to 14 regions around the world. It reflects the unpolished and ugly reality of the shipping industry in an environment of deteriorating global trade.

For the latest reporting week, the index dropped 0.6% to 636.14, its lowest level ever. It has plunged 41% from the already low levels in February last year, and 36% since its inception in 1998 when it was set at 1,000. This chart shows the continuing collapse of containerized freight rates from China to the rest of the world:

The Shanghai Containerized Freight Index (SCFI), which tracks spot-market rates (not contractual rates) of shipping containers from Shanghai to 15 destinations around the world, dropped 3.6% for the latest reporting week to 472, after another failed price recovery. It’s down 58% from February last year.

Rates to Europe plunged $20 per twenty-foot equivalent unit container (TEU) to $271; to the Mediterranean, rates plunged $29 to $409 per TEU. To the US West Coast, rates plunged 9.3% or $79 to $770 per forty-foot equivalent unit (FEU).

A year ago, the spot rates to the West Coast had already fallen 10% year-over-year, and there had been a lot of hand-wringing about them. At the time, they were $1,932 per FEU. Now they’re at $770 per FEU. In one year, these spot rates have collapsed by 60%!

During the big plunge last year and earlier this year, the saving grace was the price of bunker fuel, which was plunging along with the price of oil. For example, according to Platts, bunker of the grade IFO380 in Los Angeles had hit a low of $118 per metric ton in mid-January. But it has since soared 91% to $225!

Bunker prices differ, depending on grade and location around the world, and not all made this sort of break-neck snap-back price reversal. For example, IFO380 in Rotterdam soared “only” 61% from $109/mt in mid-January to $176/mt. Other locations and grades experienced lower price increases. But all bunker prices everywhere have risen sharply.

So the ballyhooed notion that carriers, under pressure from competition, are simply passing on their fuel savings to their customers has now died an ignominious death. Instead, their margins are getting crushed.

But there are some real reasons for the collapse in freight rates from China to destinations around the world: China’s exports have plunged. For the January through March period – to iron out the monthly volatility associated with the Lunar New Year holiday – exports are down 9.6% year-over year. Specifically:

- To the US -8.8%

- To Hong Kong -6.5%

- To Japan -5.5%

- To South Korea -11.2%

- To Taiwan -3.7%

- To the countries in the ASEAN -13.7%

- To the EU -6.9%

- To South Africa -29.6% (!)

- To Brazil -47.2% (!!)

- To Australia -1.9%

- To New Zealand -12.4%.

Exports ticked up just a tiny bit to only two major countries: India (+0.2%) and Russia (+0.2%).

So demand for transporting containers from China to other parts of the world has withered, just when the supply of container ships has reached catastrophic levels of overcapacity.

Last year, what had already been an overcapacity problem turned into a self-inflicted nightmare for carriers. They’d assumed ever since the bouts of QE and zero-interest-rate policies started that central banks had their back. They’d smelled the lure of cheap money. And they’d fallen for the central-bank propaganda that “bold” monetary policies could actually stimulate the real economy, the goods-consuming economy. And so, imagining years of big-fat growth, they ordered ships, including the newest mega-sized container ships. And as these new ships were delivered over the past couple of years, carriers embarked on a fight for market share by cutting prices.

This culminated in 2015 with the delivery of new ships that added a record 1.7 million TEU of capacity to the global fleet, just when growth in global trade was grinding down. At the same time, according to Drewry, the amount of capacity scrapped in the year plunged by nearly half, with only 195,000 TEU of global capacity taken out.

Why? “Because demolition prices were less attractive….”

Like so many things in this world where free money created overcapacity, the rates paid for ships to be scrapped has plunged from around $475 per ldt (light displacement tonnage, the weight of the vessel including hull, machinery, and equipment) in 2012 to around $290/ldt recently.

So far this year, scrapping activity has picked up. And everyone is hoping that this will alleviate the problem. But it’s not going to help much, according to Drewry:

As we have highlighted before scrapping alone does very little to redress the supply-demand imbalance – last year’s scrapping total was equivalent to just 1% of the cellular fleet….

Now carriers are hoping that the huge general rate increases they announced for May 1 – in some cases more than doubling current rates – will stick. But they tried that last spring, when overcapacity wasn’t nearly as bad, and it didn’t work. So will they have more luck this year? The Journal of Commerce put it this way: “Conditions are hardly optimal for raising rates.”

The Chinese have among the highest savings rates in the world. But 75% of their wealth is in real estate. They’ve overinvested in one illiquid and bubbly asset that they wrongly believe can only go higher. But when prices break down, it will devastate consumer demand and reverberate around the world. Read… This Will Be Largest Evaporation of Wealth in Modern History