This is all very well and good. The IMF have made demands to their puppets in Greece, which if not met, will result in the entire EU bailout to crumble to pieces. Most assuredly, this would result in markets reeling from the shock -- plunging freely towards the pits of hell.

The condensed version of the aforementioned crisis, which is definitely beginning to loom, has to do with lack of progress by the Greek government to balance a budget.

Should the IMF pullout, Germany has stated that a new deal would need to be voted on by national parliaments. The world is a much different place now, than when the last bailout was forged. With nationalism running high across Europe, there's no guarantee that a new Greek bailout will pass now, at least not without drama.

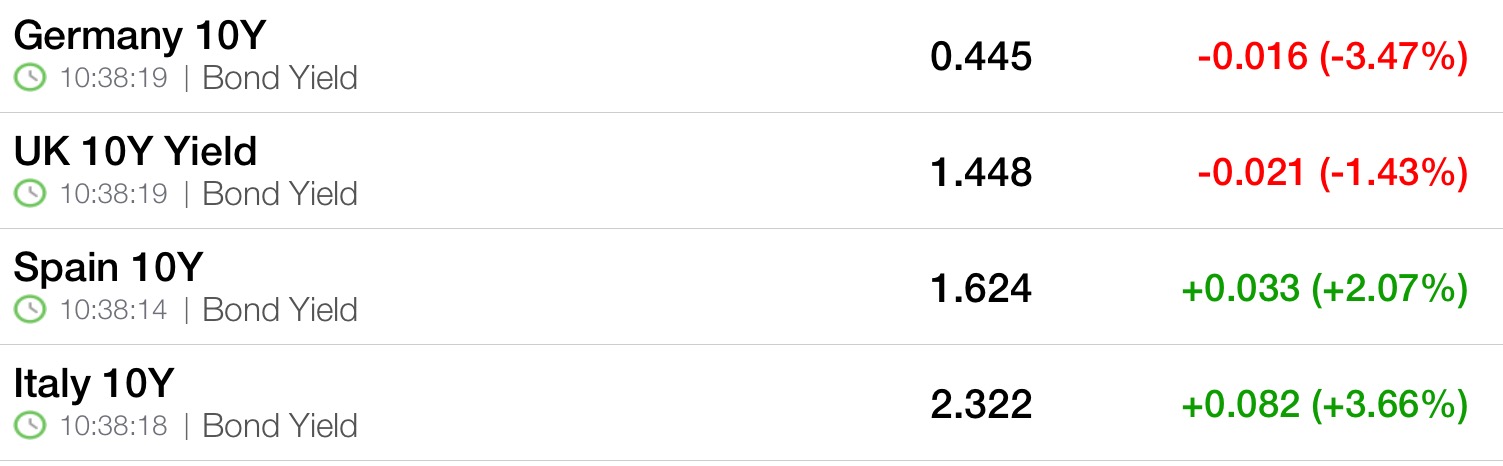

The result of this chicanery is a notable divergence between German bonds and the PIGS (Portuguese, Italian, Spaniard, Greek).

The spread between Portuguese and German bunds is now 372bps.

Source: BBG

Almost two-thirds of the actions creditors have demanded for the disbursement of the next tranche of emergency loans have yet to be completed, the government conceded in a memo discussed between Finance Minister Euclid Tsakalotos and bailout auditors last week in Brussels, a person familiar with the matter said.

Even though the memo laid out a series of commitments to ensure the work will be completed, creditors said the proposals weren’t good enough, a separate official said. The people asked not to be named as the contents of the memo haven’t been made public.

Europe’s most indebted state is locked in talks with officials representing the European Stability Mechanism, the European Commission, the European Central Bank and the IMF over the terms attached to the loans keeping it afloat since 2010.

IMF staff said in a draft report obtained by Bloomberg that the current structure of Greek public finances is “fundamentally inefficient, unfair, and ultimately socially unsustainable,” adding to doubts about whether the Fund will eventually re-join the Greek bailout. Euro area governments -- notably Germany -- have said failure to get the IMF on board would require a new agreement, which needs to be approved by national parliaments.

In addition to asking for a lower income tax threshold and pension cuts for current retirees, a demand the Greek government doesn’t accept so far, the IMF is also pushing for the European creditors to off more debt-relief measures.

“We believe that Greece’s debt burden can be manageable if the agreed reforms are fully implemented,” a spokesman for the euro area’s crisis fund said Sunday.

A European official told reporters in Brussels last week that Greece must resolve the standoff by the next meeting of euro area finance ministers on Feb. 20, before as many as five European nations hold elections that will make negotiations politically difficult.

Greek stocks plunged today by more than 3.5%.

Content originally generated at iBankCoin.com