Published

1 hour ago

on

March 5, 2024

| 26 views

-->

By

Chris Dickert

Graphics & Design

- Zack Aboulazm

The following content is sponsored by STOXX

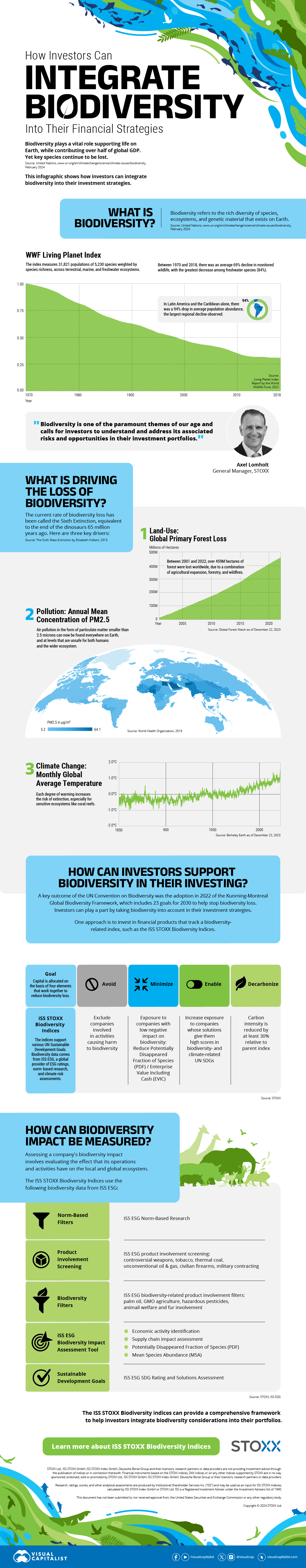

How Investors Can Integrate Biodiversity

Biodiversity plays a vital role in supporting life on Earth, which helps contribute over half of global GDP, and yet key species and ecosystems continue to be lost.

The above infographic, sponsored by STOXX, shows how investors can integrate biodiversity into their investment strategies.

What is Biodiversity?

In short, biodiversity refers to the rich diversity of species, ecosystems, and genetic material that exists on Earth. Without it, the natural processes and systems that we depend on to provide us with the food we eat and even the air we breathe could break down.

Nevertheless, according to the WWF Living Planet Index, which tracks 31,821 populations of 5,320 species across terrestrial, marine, and freshwater ecosystems, there was an average 69% decline in monitored wildlife between 1970 and 2018.

In Latin America and the Caribbean alone, which contains the Amazon rainforest (often called the lungs of the planet because of its role in producing the oxygen we breathe), there was a 94% drop in average population, the largest regional decline observed. In terms of ecosystems, freshwater species saw the greatest decline, 84%.

What is Driving the Loss of Biodiversity?

The current rate of biodiversity loss has been called the Sixth Extinction, equivalent to the end of the dinosaurs 65 million years ago, making this decade a make-it-or-break-it moment for the planet.

Here are three key factors driving the loss:

1. Land Use

According to projections from the United Nations, the global population could reach 10 billion some time in the 2050s. And all those new people will need places to live, to work, and importantly more food to eat and this means more land for new cities and new farms.

If the last 20 years are any indication, this could be bad news for global forests. According to Global Forest Watch, over 459 million hectares of forests were lost between 2001 and 2022, due to a combination of agricultural expansion, forestry, and wildfires. This adds up to a 12% decrease from 2000.

2. Pollution

Air pollution, in the form of particulate matter smaller than 2.5 microns (μg), can now be found everywhere on Earth and at levels that are unsafe for both humans and the wider ecosystem.

Kuwait, Egypt, and Afghanistan have the worst average annual PM2.5 concentrations on Earth, over 12 times safe levels, while the Bahamas, Finland, and Iceland are only slightly above the Air Quality Goal of 5 µg/m3 set by the World Health Organization .

3. Climate Change

While the exact figures are still being finalized, it is clear that 2023 was the warmest year on record, by far. And this is a problem, not only for humanity because of rising seas, wilder weather, and disrupted growing seasons, to name but a few reasons, but also for the viability for many species.

Each degree of warming increases the risk of extinction, especially for sensitive ecosystems like coral reefs, which even though they cover only 1% of the ocean’s surface, are nonetheless home to one-quarter of all marine life.

How Can Investors Support Biodiversity?

By any measure, biodiversity on Earth is under severe pressure, which is why in 2022, the parties to the UN Convention on Biodiversity adopted the Kunming-Montreal Global Biodiversity Framework, with 23 goals for 2030 to help stem biodiversity loss.

Investors can play a part by taking biodiversity into account in their investment strategies and one approach is to invest in financial products that track a biodiversity-related index, like the ISS STOXX Biodiversity Indices.

Capital is allocated on the basis of four elements (i.e. avoid, minimize, enable, and decarbonize) that work together to reduce biodiversity loss. A company’s impact can be measured by the following biodiversity data from ISS ESG:

- Norm-based filters

- Product involvement screening

- Biodiversity filters

- ISS ESG Biodiversity Impact Tool

- Sustainable Development Goals

The ISS STOXX Biodiversity Indices can provide a comprehensive framework to help investors integrate biodiversity considerations into their portfolios.

Learn more about the ISS STOXX Biodiversity Indices.

Please enable JavaScript in your browser to complete this form.Enjoying the data visualization above? *Subscribe

Related Topics: #investing #climate change #pollution #deforestation #ESG #land use #biodiversity #STOXX #extinction

Click for Comments

var disqus_shortname = "visualcapitalist.disqus.com";

var disqus_title = "How Investors Can Integrate Biodiversity into Their Financial Strategies";

var disqus_url = "https://www.visualcapitalist.com/sp/how-investors-can-integrate-biodiversity-into-their-financial-strategies/";

var disqus_identifier = "visualcapitalist.disqus.com-164835";

You may also like

-

Investor Education4 months ago

The 20 Most Common Investing Mistakes, in One Chart

Here are the most common investing mistakes to avoid, from emotionally-driven investing to paying too much in fees.

-

Stocks9 months ago

Visualizing BlackRock’s Top Equity Holdings

BlackRock is the world’s largest asset manager, with over $9 trillion in holdings. Here are the company’s top equity holdings.

-

Investor Education9 months ago

10-Year Annualized Forecasts for Major Asset Classes

This infographic visualizes 10-year annualized forecasts for both equities and fixed income using data from Vanguard.

-

Investor Education12 months ago

Visualizing 90 Years of Stock and Bond Portfolio Performance

How have investment returns for different portfolio allocations of stocks and bonds compared over the last 90 years?

-

Debt2 years ago

Countries with the Highest Default Risk in 2022

In this infographic, we examine new data that ranks the top 25 countries by their default risk.

-

Markets2 years ago

The Best Months for Stock Market Gains

This infographic analyzes over 30 years of stock market performance to identify the best and worst months for gains.

Subscribe

Please enable JavaScript in your browser to complete this form.Join the 375,000+ subscribers who receive our daily email *Sign Up

The post How Investors Can Integrate Biodiversity into Their Financial Strategies appeared first on Visual Capitalist.