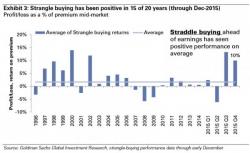

"Straddle-Up" Goldman's 'Winning' Options Strategy Into Year-End

As 2015 draws to a close, Goldman identifies 15 straddle-buying opportunities on stocks with liquid options, reporting in December. Our studies analyzing historical earnings events show at-the-money straddles are systematically undervalued ahead of the event. Buying straddles ahead of earnings has returned 10% through early December vs. the long term average of 2%.

As Goldman Sachs writes, our studies analyzing historical earnings events show at-the-money straddles are systematically undervalued ahead of the event.