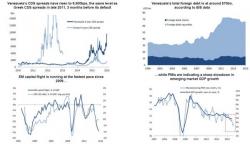

"Venezuela’s CDS Is Now At The Same Level As Greece’s Three Months Before Its Default"

In addition to being a hyperinflating, socialist banana republic with a devastated economy Venezuela has another problem: debt, of which it has some $70 billion with $9.5 billion due this year. It also has $15.4 billion in foreign reserves, of which two-thirds or around $10 billion, are held in gold bars, which as we said last week, "limits President Nicolas Maduro's government's ability to quickly mobilize hard currency for imports or debt service."