The Smart Money Is Most Worried About These Four Brand New "Tail Risks"

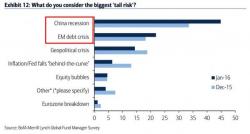

When BofA's Michael Hartnett releases his monthly Fund Managers' Survey, the one chart we always head straight to is the one laying out what the "smart money", aka the polled investors who make up the survey, is most worried about, or as they put it: what are the biggest "tail risks."

The chart below shows that as recently as a month ago, what jept everyone at night by a substantial margin, with 45% putting it as their top fear, was a China Recession, followed by an EM debt crisis.

How things have changed in the subsequent month.