Five Reasons Why The Pain For SolarCity Is Just Starting

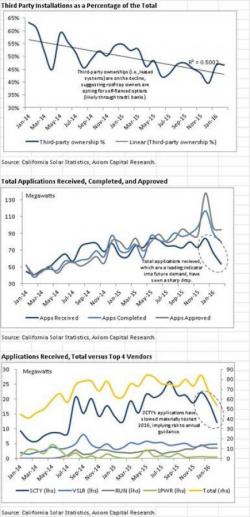

One week ago, when SolarCity was trading around $30, prompted by Jim Chanos' bearish take on the company we wrote a piece asking if "SolarCity is the next SunEdison" in which we presented the Full Bear case as noted by Axiom's Gordon Johnson, who incidentally had the only "sell" rating on the company ahead of last night's earnings debacle (at which point there were also 12 Buys and 9 Holds), which has resulted in the company plunging 25% overnight, and is about 40% lower than when we first prompted readers to pay attention to Elon Musk's solar venture.