Spitznagel Warns "Not All Risk Mitigation Is Created Equal"

Authored by Mark Spitznagel via PIOnline.com,

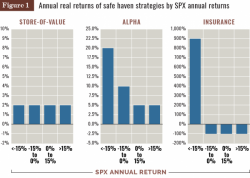

There is a movement today among pension funds toward systemic risk mitigation - or "safe haven" - strategies. This makes great sense as a potential solution to the widespread underfunding problem. Many pension funds still haven't fully recovered from the crash of 2008, and can't afford another. Moreover, truly effective risk mitigation must lead to an incrementally higher long run compound annual growth rate; and a higher CAGR is the way to raise a pension plan's funding level over time.