What Benefits To Savers? Banks Rush To Hike Prime Rate To 3.50%, Forget To Increase Deposit Rate

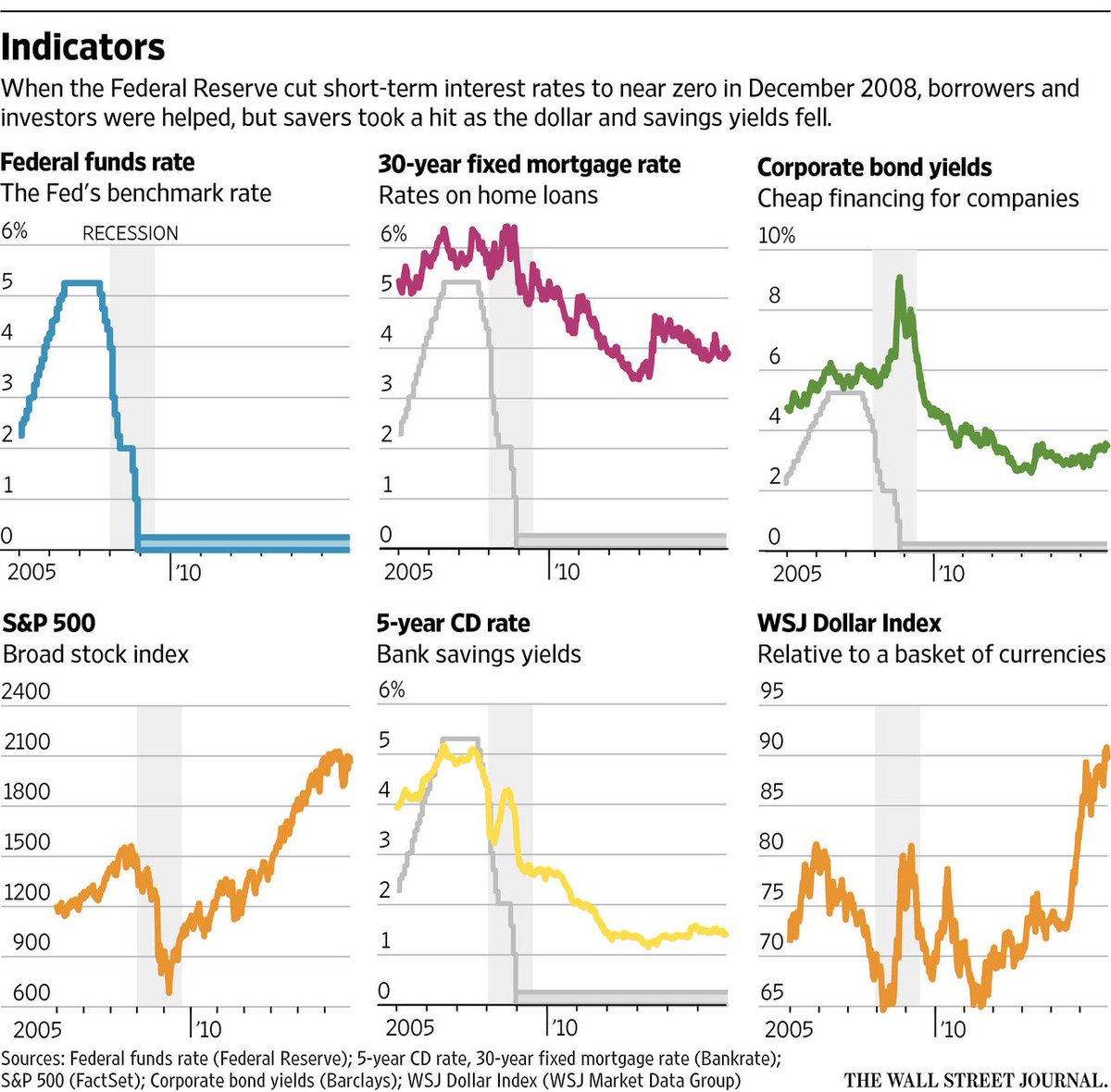

Someone forgot to give the banks the memo that the Fed's first rate hike since 2006 was supposed to, at least on paper, benefit the savers of America and not so much the, well, banks.. Because the ink hadn't even dried on the Fed's statement and one after another banks revealed that they would promptly boost their Prime lending rate from the current benchmark of 3.25% to the new Fed Funds-implied prime rate of 3.50%.

Sticker Shock: Fed to Hike Rates First Time in NINE Years!

Sticker Shock: Fed to Hike Rates First Time in NINE Years!