![]()

See this visualization first on the Voronoi app.

Use This Visualization

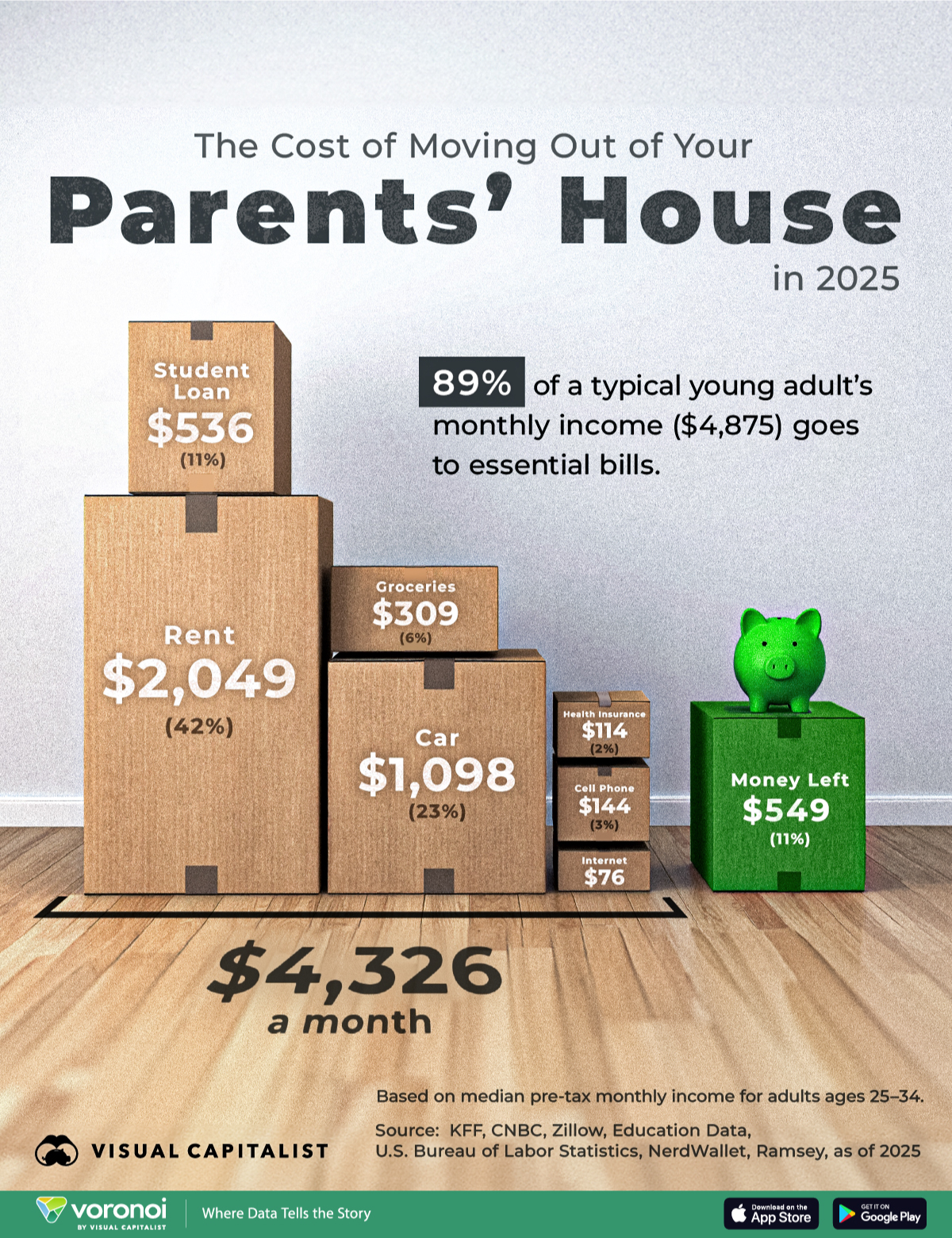

The Cost of Moving Out of Your Parents’ House

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Essential bills eat up 89% of a typical 25-34-year-old’s gross income, leaving under $600 before taxes.

- Rent hurts the most – average rent of $2,049 is more than 42% of pre-tax pay.

- Add one child and the math breaks. Child-care ($1,094/mo) pushes required spending to 111% of income.

Moving out can be a milestone of independence, but it comes at a steep cost. This chart tallies the monthly expenses facing young adults in the U.S. who leave the family home. From rent and student loans to car payments and groceries, the numbers show how quickly a paycheck disappears.

The data for this visualization comes from various sources, including the U.S. Bureau of Labor Statistics, Zillow, KFF, Nerd Wallet and CNBC. It breaks down typical monthly expenses and compares them to average earnings for people aged 25 to 34.

Rent Devours Paychecks

The single biggest cost is rent, averaging $2,049 per month, more than 42% of a young adult’s gross income. As Brookings notes, rising rents have outpaced wage growth in many urban centers, putting pressure on younger renters.

| Expenses | Cost |

|---|---|

| Rent | $2,049 |

| Student loan | $536 |

| Health insurance | $114 |

| Cell phone | $144 |

| Internet | $76 |

| Groceries | $309 |

| Car | $1,098 |

| Money Left | $549 |

Student Debt and Transportation Compound Costs

With student loan payments averaging $536 and car expenses reaching $1,098, many young adults are paying more for these two categories than for food or healthcare. According to the Urban Institute, transportation is often the second-largest expense after housing, especially in areas lacking robust public transit.

Childcare Makes Independence Unaffordable

Adding a child to the household increases the financial burden dramatically.

At $1,094 per month, childcare alone pushes the total cost of living above a typical income. This calculation does not account for a second income from a partner, which is often the case for parents and can ease financial strain.

According to Pew Research Center, this mismatch helps explain why many young adults delay having children or return to multigenerational households.

Learn More on the Voronoi App ![]()

If you enjoyed today’s post, check out The Income a Family Needs to Live Comfortably in the U.S. on Voronoi, the new app from Visual Capitalist.