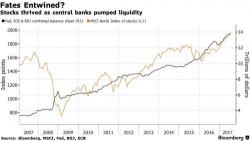

Global Stocks Hit New All Time High As Dollar Rebounds; Europe Volatile On Earnings Deluge

The levitation continues with S&P futures pointing to - what else - another higher open while European stocks swung between gains and losses on the busiest earnings days of the year (85 of the Stoxx 600 report) which has seen European pharma giant AstraZeneca plunge 15%, the most on record, after its flagship lung cancer trial Mystic failed to show benefits, while Deutsche Bank slumped 4% on a 12% plunge in FICC revenue.